Expense Reimbursement

The purpose of this resource is to support school districts in effectively utilizing Education Stabilization Fund Elementary and Secondary School Emergency Relief (ESSER) funds to meet the needs of Nebraska public school and nonpublic school students. ESSER is its own, separate, flexible program intended to assist with the COVID-19 response.

As authorized under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), these funds may be used for any activity authorized by the Elementary and Secondary Education Act of 1965 (ESEA), the Individuals with Disabilities Education Act (IDEA), the Adult Education and Family Literacy Act, the Carl D. Perkins Careers and Technical Education Act, and the McKinney-Vento Homeless Assistance Act. In addition to those authorized activities, the Act provides for additional allowable uses.

This resource is intended to provide guidance on how a public school or nonpublic school may choose to meet the needs of its students; including low-income residents of under-served areas of the state, living in very rural or concentrated urban centers, assist persons of color, persons of cultural and ethnic minorities, students with disabilities, English language learners (ELLs), students experiencing homelessness, and foster care youth. It should be noted that the supplement not supplant requirement does not apply to ESSER funds.

This resource is intended to help provide clarity to subgrantees regarding allowable uses of funds under the Nebraska CARES Act ESSER subgrant and is not a substitute for existing requirements of the subgrant agreement, subaward assurances, Grant Award Notification (GAN) terms and conditions, applicable state laws, or federal regulation (2 CFR Part 200) required by subgrantees of the award. This guidance is not meant to be exhaustive.

Timeline for Awarding, Obligating, and Liquidating ESSER Funds

As a subgrantee implements the Nebraska CARES Act ESSER subaward, it is important to be aware of the following dates that are critical to appropriate administration of the program:

Declaration of National Emergency and Pre-award Costs: March 13, 2020

- The Nebraska CARES Act ESSER subgrant may be used for any allowable expenditures incurred on March 13, 2020, or after, be reasonable and necessary and an allowable use of funds.

Department of Education ESSER Award Date: May 22, 2020

Deadline for ESSER Nebraska to Award Funds: May 22, 2021

- The Nebraska Department of Education will have one year, from the date of its ESSER award, to award funds and subgrant to LEAs. Any funds not awarded by the SEA within one year of receiving its award will be returned to the U.S. Department of Education to be reallocated to other States consistent with the CARES Act.

Obligation Date & Tydings Amendment Period: September 30, 2022

- This is the date by which any subgrantees must obligate ESSER funds to specific purposes consistent with 34 C.F.R. § 76.707. The grant period for the ESSER grant is May 22, 2020, through June 30, 2021, with 12 additional months carryover under the Tydings amendment. This means the LEA may begin to expend funds on March 13, 2020, (pre-award begin date) through September 30, 2022.This also the end of the performance period.

Liquidation Date: No later than December 30, 2022

- Under 2 CFR § 200.343(b), ESSER funds must be liquidated within 90 calendar days after the end of the performance period.

Grant Processes and Expense Reimbursement

Will the ESSER funding come to LEAs through normal grant processes?

Yes, the Nebraska CARES Act ESSER subaward will be a standard grant application with expense reimbursement being requested through the Nebraska Grant Management System (GMS) portal.

Purpose of Primary Documentation and the NDE Reimbursement Review

To ensure the existence of primary documentation necessary to support fiscal reviews, including audits and improper payment assessments by the department, a subrecipient is required to submit adequate documentation for every federal award reimbursement requested, be attached to the payment voucher, reviewed, and approved prior to award reimbursement. This includes but in not limited to; a copy of the signed contract for purchase orders, an invoice with performance dates and/or deliverables approved by project manager, copies of receipts, and general ledger detail as necessary.

A Grant Management Specialist will review and approve reimbursement requests based on the following criteria and scope of the reimbursement request, ensuring costs are allowable, allocable, and reasonable:

Allocated Costs – charged in proportion to benefits received, allowable under 2 CFR 200.400 et al., and charged to non-program areas for the benefits they receive.

Authorized Expenditures – in accordance with the fully executed grant agreement and within budgetary authority

Allowable and Reasonable – reimbursement requests are reviewed to verify they are in fact: 2 CFR 200.403 Allowability and 2 CFR 200.404 Reasonable

- Necessary for the performance of the federal grant award.

- Reasonable for the goods or services provided.

- Allocable and charged in proportion to the benefit received.

- Legal under state law and regulations.

- Conform to federal law, award term and conditions, and period of the award.

- Treated the same as non-federal expenditures.

- Comply with Generally Accepted Accounting Principles.

- In compliance with and requirement or restriction imposed by the grant.

- Net of any credits.

- Appropriate supporting documentation such as: invoices, purchase orders, agreements.

- Personnel cost are identified per funding source

Expenditure Coding – references appropriate expenditure coding, acceptable ties to budget if a Final Financial Report (FFR), in-line with general ledger supporting documentation, and appropriate Business Unit for payment.

Indirect Cost Allocation Rate – reference the correct approved rate and allowability under 2 CFR 200.414.

Computations for Accuracy – with exceptions returned for correction.

Supporting Documentation – accounted for and attached prior to processing for payment.

ESSER is its own, separate, and flexible program intended to support COVID-19 response efforts. Guidance states that all grants be used “to prevent, prepare for, and respond to coronavirus.” The Nebraska Department of Education recognizes the expanded risk and opportunities associated with this Federal grant program and will require primary documentation from all subrecipients at the reimbursement request level prior to fiscal monitoring to be allowable.

Allowable Uses of Funds

The expenditure must be an allowable activity under the CARES Act. The allowable uses of ESSER Funds are outlined in Section 18003(d) of the CARES Act. This section reads as follows:

“A local education agency that receives funds under this title may use the funds for any of the following:

- Any activity authorized by the ESEA of 1965, including the Native Hawaiian Education Act and the Alaska Native Educational Equity, Support, and Assistance Act (20 U.S.C. 6301 et seq.), the Individuals with Disabilities Education Act (20 U.S.C. 1400 et seq.) (‘‘IDEA’’), the Adult Education and Family Literacy Act (20 U.S.C. 1400 et seq.), the Carl D. Perkins Career and Technical Education Act of 2006 (20 U.S.C. 2301 et seq.) (‘‘the Perkins Act’’), or subtitle B of title VII of the McKinney-Vento Homeless Assistance Act (42 U.S.C. 11431 et seq.).

- Coordination of preparedness and response efforts of local educational agencies with State, local, Tribal, and territorial public health departments, and other relevant agencies, to improve coordinated responses among such entities to prevent, prepare for, and respond to coronavirus.

- Providing principals and others school leaders with the resources necessary to address the needs of their individual schools.

- Activities to address the unique needs of low-income children or students, children with disabilities, English learners, racial and ethnic minorities, students experiencing homelessness, and foster care youth, including how outreach and service delivery will meet the needs of each population.

- Developing and implementing procedures and systems to improve the preparedness and response efforts of local educational agencies.

- Training and professional development for staff of the local educational agency on sanitation and minimizing the spread of infectious diseases.

- Purchasing supplies to sanitize and clean the facilities of a local educational agency, including buildings operated by such agency.

- Planning for and coordinating during long-term closures, including for how to provide meals to eligible students, how to provide technology for online learning to all students, how to provide guidance for carrying out requirements under the Individuals with Disabilities Education Act (20 U.S.C. 1401 et seq.) and how to ensure other educational services can continue to be provided consistent with all Federal, State, and local requirements.

- Purchasing educational technology (including hardware, software, and connectivity) for students who are served by the local educational agency that aids in regular and substantive educational interaction between students and their classroom instructors, including low-income students and students with disabilities, which may include assistive technology or adaptive equipment.

- Providing mental health services and supports.

- Planning and implementing activities related to summer learning and supplemental after school programs, including providing classroom instruction or online learning during the summer months and addressing the needs of low-income students, students with disabilities, English learners, migrant students, students experiencing homelessness, and children in foster care.

- Other activities that are necessary to maintain the operation of and continuity of services in local educational agencies and continuing to employ existing staff of the local educational agency.”

The USED generally does not consider the following to be an allowable use of funds:

- Bonuses, merit pay, or similar expenditures, unless related to disruptions or closures related to COVID-19.

- Subsidizing or offsetting executive salaries and benefits of individuals who are not employees of the school district.

- Expenditures related to state or local teacher or faculty unions or associations.

TECHNICAL ASSISTANCE: What are allowable and unallowable costs?

Determine the Appropriateness of Coding an Expenditure & Documenting

Not sure about the appropriateness of coding an expenditure to ESSER, ask these 3 questions:

- Does this expenditure prevent, prepare for, and respond to Coronavirus?

- Will coding this expenditure to the Nebraska CARES Act ESSER subaward in the fiscal year being expensed still allow the LEA to meet Maintenance of Effort (MOE) requirements for other awards?

- Did this expenditure occur on or after March 13, 2020?

What is the absolute minimum that should be documented?

At an absolute minimum, document the expenditures as you normally would and specify in writing:

-

- The need for the expenditure,

- If using federal funds, why federal funds are needed to address the need, and

- That it is COVID-19 related.

Equitable Services and Fiscal Requirements

What can appropriately be coded to ESSER for nonpublic equitable services?

An school district must offer to provide equitable services to students and teachers in all non-public schools located in the school district, even if a non-public school has not previously participated in federal education programs, such as Title I, Part A or Title VIII of the Elementary and Secondary Education Act (ESEA). The nonpublic may identify allowable services to meet their needs and those nonpublic services are not required to be the same as the services the school district provide to its campuses, students, or staff.

The expenditure must be an allowable activity under the CARES Act, including IDEA & ESEA activities, as well as technology purchases for students, supplies to sanitize & clean schools, mental health services & supports, summer learning and afterschool programs is allowable to provide equitable services to the nonpublic. The allowable uses of ESSER Funds are outlined in Section 18003(d) of the CARES Act and under the ‘Required Elements for Supporting Documentation’ section of this FAQ.

Fiscal requirements when providing equitable services to the nonpublic:

- Control of the funds, must remain with the school district and the school district, must administer such funds. In other words, no funds go directly to the nonpublic.

- A school district must have title to materials, equipment, and property purchased with subgrant funds and must follow its policies and procedures with regards to inventory, as applicable.

- Materials, equipment, and services must be secular, neutral and nonideological.

- Services must be provided by the school district directly, or through contract with, another public or private entity. (Section 18005(b) of the CARES Act.)

For example:

Purchasing materials or goods for the nonpublic:

- A school district should purchase the goods needed by the nonpublic and directly remits payment to the vendor.

- A nonpublic school could purchase the goods; however, the school district must remit payment directly to vendor on the nonpublic behalf to be an allowable expenditure under the program.

Providing and/or purchasing services for the nonpublic:

- Services must be provided or administered by the school district.

- An employee of the school district may provide such service.

- Paying nonpublic employees are not staff of the school district (Category 12); therefore, would be unallowable.

- Or, contracted with another public or private entity to provide.

- Contracts for services provided must be paid directly to the public or private agencies, organizations, or institutions providing the service.

- Districts provide equitable services to the extent that the proportionate share lasts.

- Districts need to have documentation that shows how the proportionate share funds were obligated and expended for, or on behalf of, the private school, its students, and/or its teachers.

- Districts need to keep the proportionate share funds separate and distinct for auditing and monitoring purposes.

- Written documentation supporting:

- The need for an expenditure,

- If using federal funds, why federal funds are needed to address the need, and

- That it is COVID-19 related.

- Districts may use some of the equitable services funds for administrative costs as long as those administrative costs are reasonable and necessary for administering equitable services under the Nebraska CARES Act ESSER program.

- Consumables/disposables (e.g., masks, shield guards, cleaning supplies) are allowable if the district purchases pursuant to its policies and procedures.

- Districts cannot pay for nonpublic school staff salaries (Category 12) as no funds may go directly to the nonpublic.

- If technology (e.g., laptops) are purchased, districts own the property, must inventory, and keep an accounting pursuant to its inventory policies and procedures.

- Post award guidance calls with the USED, indicated that construction as part of private nonprofit (PNP) equitable services is not allowable under the program.

NOTE: many federal programs (e.g., ESSA Title I, Title II, Title III, IDEA) require equitable services. Equitable services requirements under those federal programs may differ, please direct questions to:

Jim Kent | 402-471-1749 | Jim.Kent@nebraska.gov

Nebraska Department of Education

Office of ESEA Programs, Title Consultant, Nonpublic Ombudsman

Can a nonpublic have COVID-19 related expenses that occurred on or after March 13, 2020 reimbursed?

School districts are not permitted to reimburse a nonpublic for activities that were paid for by the nonpublic and the nonpublic cannot accept federal funding. However, under the Nebraska CARES Act ESSER subgrant, the school district can reimburse through alternative methods for COVID-19 related expenditures that occurred on or after March 13, 2020.

For a nonpublic to have COVID-19 related allowable expenses reimbursed, the nonpublic will need to determine the status of their COVID-19 related invoices. If the invoice has been paid by the provider, the nonpublic can work with the vendor or service provider to issue a refund and ask to invoice the school district. If the invoice has not been paid, the nonpublic can ask the provider to re-issue the invoice to the school district for payment.

This process and the allowability of expenses must be addressed during the consultation (or amended expenditure plan) between the nonpublic and the district and an agreement must be met before reimbursement can occur for the allowable COVID-19 related expenses. Please direct questions to:

Jim Kent | 402-471-1749 | Jim.Kent@nebraska.gov

Nebraska Department of Education

Office of ESEA Programs, Title Consultant, Nonpublic Ombudsman

How does a recipient account for equitable services under the original inter final rule and after vacating the inter final rule?

On September 28, 2020, the Commissioner of the Nebraska Department of Education, provided the following CARES ACT Equitable Services Update:

On September 4, 2020, in NAACP v. DeVos, the U.S. District Court for the District of Columbia issued an opinion and an order vacating the Interim Final Rule (IFR) under the CARES Act in its entirety nationwide. This order “vacates” the rule, leaving no IFR in place for the U.S. Department of Education (USED) to enforce in any jurisdiction.

The USED respects the rule, will enforce the law as the courts have opined, and will not appeal these rulings. The USED will not take any action against States or local districts that followed the guidance and/or the IFR prior to notice of the court’s decision. See attached letter from the Secretary of Education.

With this guidance, going forward the Nebraska Department of Education (NDE) is honoring and reimbursing school districts for expenditures already made through September 11, 2020 under contracts and agreements for the provisions of services or goods provided to private schools, the NDE notified Nebraska schools of the court order.

For ESSER funds not under contract or agreement for the provision of equitable services to private schools after September 11, 2020, school districts must provide consultation and calculate the minimal proportional share according to the formula required under Section 1117 of the ESEA of 1965, which the USED will enforce to ensure school districts comply with this and other relevant equitable services requirements.

If you have questions, please contact:

Brian Halstead | Brian.Halstead@nebraska.gov

Nebraska Department of Education, Deputy Commissioner

NOTE: Items purchased before September 11, came in after September 11, for which purchase orders, sales order, subscriptions, were sent to vendors on or before September 11, 2020, can be completed since all parties detrimentally relied upon the guidance/interim final rule from the U.S. Department of Education and September 11, 2020 was when the Nebraska Department of Education notified all recipients of the Nebraska CARES Act ESSER subgrant award that the U.S. Department of Education interim final rule guiding equitable services was vacated.

NOTE: Contracts or agreements signed with individuals, or entities to provide services, on or before September 11, 2020, for services to occur in nonpublic schools for the 2020-21 school year as part of equitable services can be honored for the term of the contract or agreement since all parties detrimentally relied upon the guidance/interim final rule from the U.S. Department of Education and September 11, 2020 was when the Nebraska Department of Education notified all recipients of the Nebraska CARES Act ESSER subgrant award that the U.S. Department of Education interim final rule guiding equitable services was vacated.

NOTE It is important to maintain date specific primary documentation supporting and identifying the administration of, contracting for services, and purchasing for equitable services provided before and after the interim final rule:

- Invoice,

- Receipt,

- Purchase Order/Sales Order,

- Contract/Agreement for service provided; original and amended, and

- Email.

Account Coding Reimbursements

What fiscal year should these funds be account for?

The funds should be accounted for in the fiscal year in which they are expended or received.

What account codes should be used for expenses and revenue incurred under ESSER?

For accounting purposes:

Expenses Function Code: 6996

Revenue Function Code: 4996

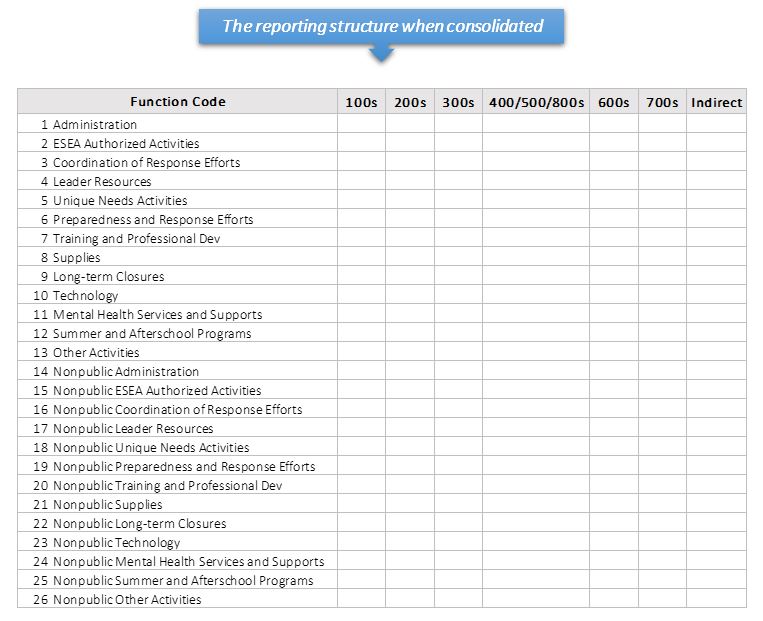

How will the ESSER allowable activities for which a transaction is charged be captured for federal reporting?

Implement a subcategory, local option code, or intent code in your accounting system in order to specifically identify costs related to the ESSER allowable activities for which funds will be expended or a transaction is charged.

The following demonstrates the Nebraska CARES Act ESSER award function/object code structure for the budget application and expense reimbursement requests in the Grants Management System (GMS) for public and nonpublic expenditures.

Function Codes: Object Codes:

- Administration 100 – Salaries

- ESEA Authorized Activities 200 – Employee Benefits

- Coordination of Response Efforts 300 – Professional & Technical Services

- Leader Resources 400/500/800 – Other Purchased Services

- Unique Needs Activities 600 – Supplies

- Preparedness and Response Efforts 700 – Capital Assets

- Training and Profession Dev Indirect Costs

- Supplies

- Long-term Closures

- Technology

- Mental Health Services and Supports

- Summer and Afterschool Programs

- Other Activities

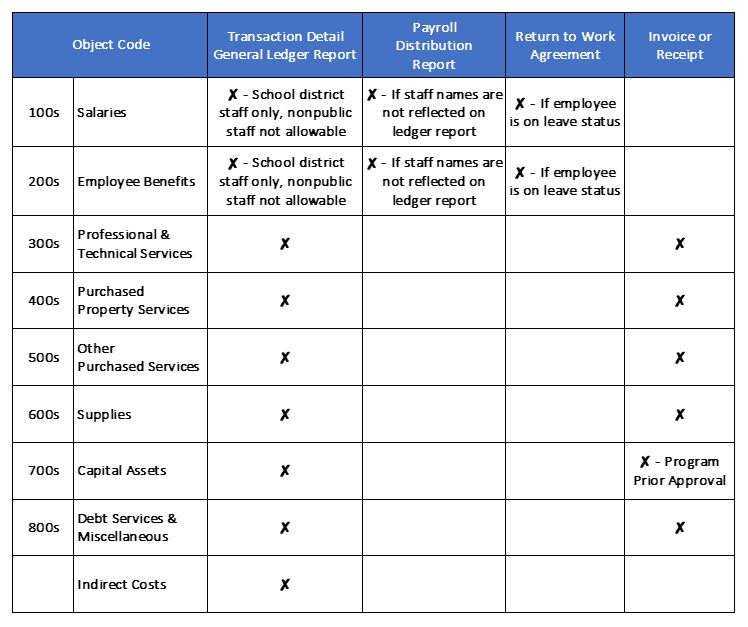

Required Documentation for Reimbursement

What supporting documentation is required when requesting expense reimbursement for ESSER public and nonpublic equitable services expenditures?

This is a general listing of required supporting documentation for requesting expense reimbursement by object code. Additional documentation may be required depending on the circumstances or activity preventing, preparing for, or responding to Coronavirus.

What supporting documentation is required when requesting expense reimbursement for capital outlay expenditures?

Construction Activities – Including Renovations and Remodeling

Because ESSER funds may be used for “any activity authorized by the ESEA,” and construction is an allowable activity under the ESEA’s Impact Aid program, an school district may use ESSER funds for construction, subject to prior written approval by the Nebraska Department of Education Office of ESEA Programs. See section 18003(d)(1) of the CARES Act, Title VII of the ESEA, and 2 CFR § 200.439(b)(1). Specifically, the Impact Aid definition of “construction” includes remodeling and renovations, under which many activities related to COVID-19 would likely fall.

Purchase of Equipment

As is the case with all activities charged to the ESSER Fund, equipment costs must be reasonable and necessary to meet the overall purpose of the program, which is “to prevent, prepare for, and respond to” the COVID-19 pandemic. Therefore, any equipment activities, that would be necessary for a school district to prevent, prepare for, and respond to COVID-19 would be permissible with prior written approval by the Nebraska Department of Education Office of ESEA Programs. See 2 CFR § 200.407 (Prior Written Approval), 2 CFR § 200.313 (Equipment), 2 CFR § 200.439 (Equipment and other capital expenditures), and 2 CFR § 200.1 for the definitions of capital expenditures, equipment, special purpose equipment, general purpose equipment, acquisition cost, and capital assets.

For prior written approvals, please contact:

Beth Wooster | 402-471-2452 | Beth Wooster@nebraska.gov

Nebraska Department of Education

Office of ESEA Programs, Administrator

Required Elements for Supporting Documentation

This is a general listing of the basic elements required for supporting documentation to be submitted for expense reimbursement and be retained for a minimum of 5 years. The required primary documentation is the same for public and nonpublic financial activity.

Be an Allowable Uses of Funds

The expenditure must be an allowable activity under the CARES Act. A school district that receives funds under this title may use the funds for any of the 12 allowable uses of funds. The allowable uses of ESSER Funds are outlined in Section 18003(d) of the CARES Act

Incurred on or After March 13, 2020

The expenditure must have occurred on or after March 13, 2020; the date the President declared the national emergency due to COVID-19.

General Ledger Transaction Detail Report

In order to determine if an expenditure is allowable, allocable, and reasonable, all general ledgers transaction detail reports should contain, at a minimum, the following elements:

- Account Coding:

- To be an allowable expenditure, the activity must be coded to the proper accounting code 6996 for the CARES Act ESSER subaward.

- Best practices would include a subcategory, local option, or intent code to indicate the expense was ESSER COVID-19 related, which allowable use, and if utilized for equitable services.

- Predetermined set of cost categories and commodity codes used for the purpose of calculating aggregate costs

- Transaction date: On or after March 13, 2020

- Transaction reference number: check number, purchase/sales order number

- Transaction description

- Vendor name

- Budgeted amount

- Obligated/Encumbered amount

- Expenditure amount

Payroll Distribution Report

If employee names are not reflected on the ledger report, include a payroll distribution report.

NOTE: Salary only being charged to a grant is not reasonable and therefore unallowable. Per 2 CFR 200.430 Compensation-personal services and 2 CFR 200.431 Compensation-fringe benefits salary and benefits cost must be equitably allocated to all related activities, including Federal awards. For example: if 70% of salary charged to a grant, 70% of benefits must also be charged to that grant.

Return to Work Agreement

In an employee is on leave status, a return to work agreement will be necessary for reimbursement.

Invoice and/or Receipt

An invoice is a document issued to customers by a seller asking for payment of goods or services. An invoice is a document presented to the customer before or after supplying the goods or services.

A receipt is less detailed and does not require a unique identification number or customer information, however, do contain important information about a transaction.

NOTE: Invoices and/or receipts not containing the necessary elements must be accompanied by the originating purchase order or contract for services.

Essential Elements of An Invoice:

- The word Invoice.

- Seller’s name and address contact details and company registration number.

- Buyers name and address.

- Date:

- Invoice issue date,

- Payment due date,

- Delivery date, and

- Purchase order date and/or Sales Order date.

- A unique invoice number or a unique identifier.

- Goods or services purchased:

- Item name or title of service that was provided,

- Price of the item or service,

- Amount or quantity of product or service purchased,

- Cost per unit, and

- Total item cost.

- Total amount charged with tax information.

- Available payment methods, including bank account number and a reference code identifying the customer.

Essential Elements of a Receipt:

- Business name and contact information,

- Date of sale,

- An itemized list of sold products or services,

- The price of each sold product and service,

- Any discounts or coupons, and

- The total amount paid, including any sales tax or fees.

Adjusting Journal Entries

If an expense reimbursement required an adjusting journal entry into the Nebraska CARES Act ESSER account coding, please include supporting documentation which support the adjustment and the original general ledger transaction detail showing where the initial activity was coded and journal from.

For example: payroll journals should contain, at a minimum, the following elements:

- Account coding to the ESSER account code (6996) which payroll cost will be charged,

- Employee first and last name, and identification number

- Gross salary and other income, deductions, and net earnings,

- Pay period, check date, and check number,

- All fund codes to which the payroll costs were charged, and

- Original general ledger transaction detail report.

NOTE: If an employee is paid from multiple funding sources, i.e., state and federal, include payroll distribution records that includes payroll costs charged to each contributing funding source.

NOTE: If an employee’s name is not reflected on the ledger report, include payroll distribution records.

Equitable Services and Expense Reimbursement

The following generally identifies fiscal elements which are necessary for an equitable services expense reimbursement to be allowable under the Nebraska CARES Act ESSER subaward:

- Must be an allowable use of funds for the equitable services ESSER program.

- Occurred on or after March 13, 2020.

- Coded to the proper accounting code 6996 for the CARES Act ESSER subaward.

- Be support by the appropriate supporting documentation listed, under the “Required Supporting Documentation” and “Required Elements for Supporting Documentation” sections in this FAQ, and necessary for the cost categories (object codes) requesting reimbursement.

- Reimbursement for materials or goods for the nonpublic whether ordered by the public or nonpublic must be supported with payment from the school district directly to the vendor.

- Reimbursement for services provided or administered by the school district may only be for salaries, benefits, and material necessary for the school district to provide the service. Paying nonpublic employees are not staff of the school district (Category 12); therefore, would be unallowable.

- Reimbursement for contracts with another public or private entity to provide service to the nonpublic, must be paid directly to the public or private agencies, organizations, or institutions providing the service.

- Construction and/or remodeling costs are not an allowable equitable service expenditure.

Nonpublic COVID-19 related expenditures that occurred on or after March 13, 2020 must accompany a public/nonpublic consultation agreement for expenditure reimbursement and the nonpublic must have directly paid the vendor or service provider.

Contact

Budget & Grants Management

Jen Utemark

Office of Budget & Grants Management, Administrator

(402) 471-4313 | jen.utemark@nebraska.gov

Tom Goeschel

Office of Budget & Grants Management, Director or Compliance

(402) 890-8912 | tom.goeschel@nebraska.gov

Services Provided:

Support to grant programs, personnel, and schools

- Operational budget and legislative activities

- Financial management,

- Grants management and reimbursement

- Grant reporting,

- Compliance, and

- Fiscal Monitoring

ESEA Programs

Beth Wooster

Office of ESEA Programs, Administrator

(402) 471-2452 | beth.wooster@nebraska.gov

Services Provided:

Programmatic support to public school districts, public and nonpublic schools, and program personnel:

- Technical,

- Managerial, and

- Monitoring

Manages federal funds allocated for use by nonpublic schools